Thom Roddy with Craig Jackson – Published March 26, 2024

In our pursuit of clarity regarding the utilization of tourism tax dollars in violation of the 2004 Amendment, we approached the Board of Commissioners for insights. Board Chair Bob White’s response shed light on the matter, albeit indirectly, stating, “This is an attorney-client closed session item. It will remain that way until we have a course of action that we can present to the public.” White’s remark appears to imply a connection to the county attorney during the 20-year span in question.

Seeking further clarification, we reached out to county manager Donald Ike McRee, who served as county attorney during this period. Our inquiry was direct: “Given the plain language and lack of ambiguity in the bill, did you inform the board of these changes and recommend compliance with the law? If not, what was your legal basis for non-compliance?” Regrettably, our attempts to solicit a response from McRee went unanswered.

The reality that emerges is stark: over the past two decades, the county has persistently diverted tourism tax dollars to cover or reimburse the general fund for disallowed services, including construction, maintenance, and police protection. Despite the court’s recognition of the commissioners’ good faith, a critical question remains unanswered: who provided guidance to the commissioners, leading them to believe they were acting lawfully while flouting the revised statute? The job description for the county attorney explicitly stipulates a “thorough knowledge of State General Statutes pertaining to the administration of County government.” Thus, the lingering inquiry resonates loudly: “Who sanctioned the commissioners to operate under the guise of good faith despite violating the statute?”

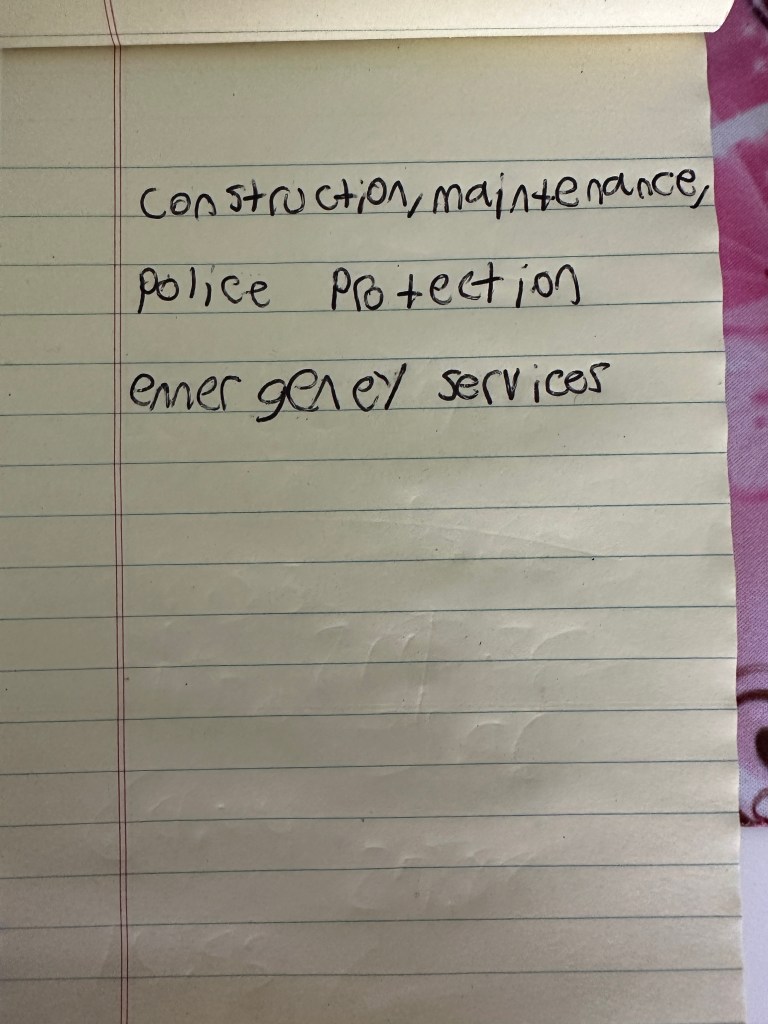

We looked at the Session Law 2004-95 House Bill 1721 to see where the ambiguity in this change in law lies. We found a clear and concise language shift, narrowing the scope of allowable tourism-related expenses. Below is a copy of the bill. We have highlighted the current text in yellow and highlighted the text from the deleted bill in red. Thom Roddy, founder at BlackwaterReports, ran the 5th Grader Test with a real live 5th grader. In this test, Roddy explained that yellow was something you could do, and red was something you used to be able to do but couldn’t do anymore. The 5th Grader was asked to read the entire Bill and then list the things you can’t do anymore.

An actual 5th grader’s thoughts on tourism tax dollars:

“Hey, 5th graders! So, you know how when people visit our county, they pay a little extra money called tourism tax? That money is meant to make their visit better, like fixing up parks or making cool events. But there are rules about what we can and can’t spend that money on. For example, we can’t use it to build regular roads or pay for regular police officers because those things help everyone, not just tourists. We also can’t use it to pay for things like new schools or fixing up buildings that aren’t for tourists. So, basically, the tourism tax dollars are like a special fund just for making tourists happy when they come to visit us!“

This 5th grader is interested in being the county manager…

Please feel free to share our content.